【Metaverse News】Industrial and Commercial Bank of China's digital RMB smart contract platform, accelerating the implementation of application scenarios

The earliest institution to lay out smart contracts, Industrial and Commercial Bank of China, based on the functional positioning of digital RMB operating institutions, conscientiously implements the overall layout of the People's Bank of China, fully leverages the advantages of digital RMB programmability and advanced technology in smart contracts, builds an independent, controllable, open and compliant digital RMB smart contract platform, launches a series of digital RMB smart products, and accelerates the implementation of digital RMB application scenarios, Innovate and create a new ecosystem of digital RMB intelligent finance, and assist the strategic development of Digital Industrial and Commercial Bank of China to achieve stability and progress.

1、 Digital RMB smart contract platform to reduce performance costs of economic activities

Industrial and Commercial Bank of China follows the standards and specifications of the People's Bank of China's digital RMB smart contract. Based on the platform's open and interconnected technological capabilities, it integrates the independently developed blockchain technology platform ICBC Xilian, and utilizes its programmable advantages by loading smart contracts on digital RMB. It is the first digital RMB smart contract platform in the industry to integrate full process management, template standardization sharing, and identity diversity recognition. The platform is equipped with subsystems such as contract configuration and contract operation, which are interconnected with the People's Bank of China's smart contracts. It supports developers to create contract templates, operational agencies to execute and verify contracts, and other smart contract lifecycle management. It is also organically integrated with digital RMB payments, achieving a new payment model of "rules+payments".

The digital RMB smart contract function, with its unique technical features such as mandatory performance, automatic execution, and link traceability, provides fund payment modes such as targeted payment, targeted allocation, and prepayment freezing. It has shown strong potential in financial innovation by collaborating with partners in industries such as government subsidies, fund supervision, investment and wealth management, flexible employment, prepaid consumption, and supply chain finance, Explore new business models that are different from traditional payment paths and build a comprehensive ecosystem of smart contract services.

In terms of external cooperation, the smart contract platform provides standard API output, and the docking method is simple and convenient, reducing the development workload and costs of the partners themselves, enabling them to focus more on the development of core businesses.

The platform has been promoted in recent years, covering 17 provinces and cities such as Hebei, Guangdong, Jiangsu, and Sichuan. It actively participates in the construction of the Universiade and Asian Games scenarios, connects with over 500 cooperative institutions, and serves more than ten industries including digital government, retail consumption, and business empowerment. It effectively reduces the cost of economic activities, optimizes the business environment, and promotes the deepening development of the digital economy.

2、 Innovate and launch scenario intelligent products to enrich digital RMB applications

Industrial and Commercial Bank of China leverages the advantages of collaborative innovation in business technology, fully utilizing the transparent and trustworthy, automatic execution, and mandatory performance characteristics of the digital RMB smart contract platform. In application scenarios such as consumption red envelopes, prepaid fund management, and fund deposit management, ICBC innovatively launches product applications based on smart contracts, providing more diverse financial services for customers and providing smarter financial guarantees for China's digital economy construction.

1. Digital RMB intelligent red envelope products

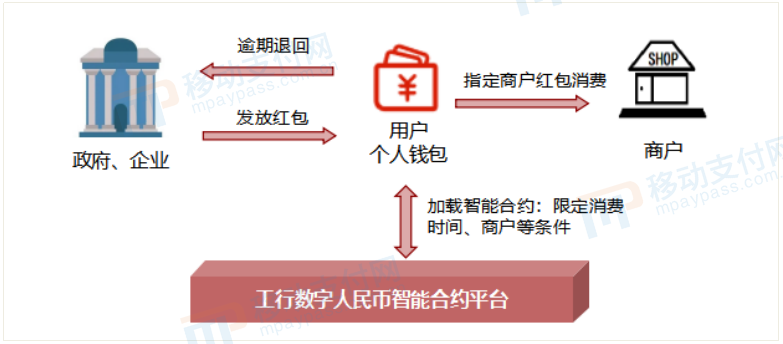

The digital RMB intelligent red envelope product refers to Industrial and Commercial Bank of China, as a digital RMB operating institution, utilizing the programmable characteristics of digital RMB and loading smart contracts on the digital RMB string, supporting government agencies, internet platforms, merchants, commercial banks and other market entities to provide personal wallet customers with consumption red envelope services for deducting cash, encouraging consumption, and targeted use.

The digital RMB smart red envelope product limits the usage rules of the digital RMB red envelope through smart contracts. The smart targeted payment is made to designated merchants, and the unused red envelope balance is automatically refunded upon expiration, effectively achieving "one clear, unused and refundable". Since the pilot, Industrial and Commercial Bank of China has organized and participated in more than 190 digital RMB red envelope activities, helping 56 cities to provide about 2 billion yuan of anti epidemic funds to their homes, benefiting more than 3.2 million people such as angels in white, disaster stricken people, and local holiday residents from point to point. They have also paid for consumption in 100000 designated commercial households related to clothing, food, housing, and transportation, using smart finance to support people's livelihood security and boost consumption.

2. Digital RMB intelligent prepaid butler product

Digital RMB intelligent prepaid butler business refers to the intelligent product provided by Industrial and Commercial Bank of China as a digital RMB operating institution, utilizing the programmable characteristics of digital RMB and deploying smart contracts in digital wallets to support merchants or platforms to provide prepaid consumption services to users in accordance with the law. This product can effectively prevent the illegal appropriation of prepaid funds and ensure the safety of user funds.

Industrial and Commercial Bank of China fully leverages its advantages in technology research and development, product innovation, and scenario construction in the field of prepaid consumption. It actively cooperates with the top life service e-commerce platform Meituan to carry out digital RMB intelligent prepaid butler business, providing Meituan with digital RMB intelligent prepaid butler services, and issuing prepaid consumption service cards that can be used in online e-commerce consumption scenarios on the Meituan APP. The usage scope covers Meituan takeout, on-site catering Buying groceries, cycling, optimizing, etc., to meet the business demands of platform merchants to provide customers with prepaid consumption services.

Meituan Prepaid Cartoon uses smart contracts to control the security of users' prepaid consumption service funds, changing the pain points of traditional prepaid consumption, such as difficulty in terminating consumption refunds, closing business for recovery, and providing evidence for consumer rights protection. Consumers' prepaid funds are protected in digital RMB packets according to smart contracts and released to merchants one by one according to actual consumption situations, solving the trust problem between merchants and consumers, and reducing the misappropriation of funds by merchants The risk of damaging consumer rights. At the same time, establish a full lifecycle management capability for card purchase, recharge, consumption, return, gift, and refund, making it convenient for users to use and effectively protecting the legitimate rights and interests of consumers and their finances

3、 Future outlook

The future has come, and the digital ICBC strategy has fully set sail. The Industrial and Commercial Bank of China's digital RMB smart contract platform will continue to empower financial innovation in the fields of fund supervision, enterprise operation, and smart people's livelihood. With its strong performance and fund monitoring capabilities, it will enhance the level of digital financial services and financial inclusion, effectively preventing financial risks. While serving a large number of individual customers, Industrial and Commercial Bank of China will continue to provide standardized solutions and products for digital RMB smart contracts to interbank banks, government agencies, enterprises and institutions, actively promoting the rapid integration of smart contracts into various financial products and application scenarios both inside and outside the bank, promoting the integration of cooperative institutions, continuously innovating business models, and jointly creating a "mutually beneficial and win-win" digital RMB smart financial ecosystem, Assist China's digital economy development to a new level.

Looking around the world, with the continuous enhancement of China's comprehensive national strength and the improvement of its international status, the internationalization of the RMB is gradually recognized as a market choice process. Various sectors of society are paying more attention to the realization of cross-border use of digital RMB and the promotion of RMB internationalization. Under the guidance of the People's Bank of China, Industrial and Commercial Bank of China will continue to actively study the applicability of digital renminbi in the cross-border field. With the help of blockchain technology, it will promote data sharing, optimize business processes, reduce operational costs, improve collaborative efficiency, and build a trustworthy system. It will explore the needs of smart contracts in addressing the convenience, security, intelligence, and compliance of digital renminbi international payments, and help build a "non-destructive" system A compliant and interconnected digital currency international payment environment.

中文

中文

English

English